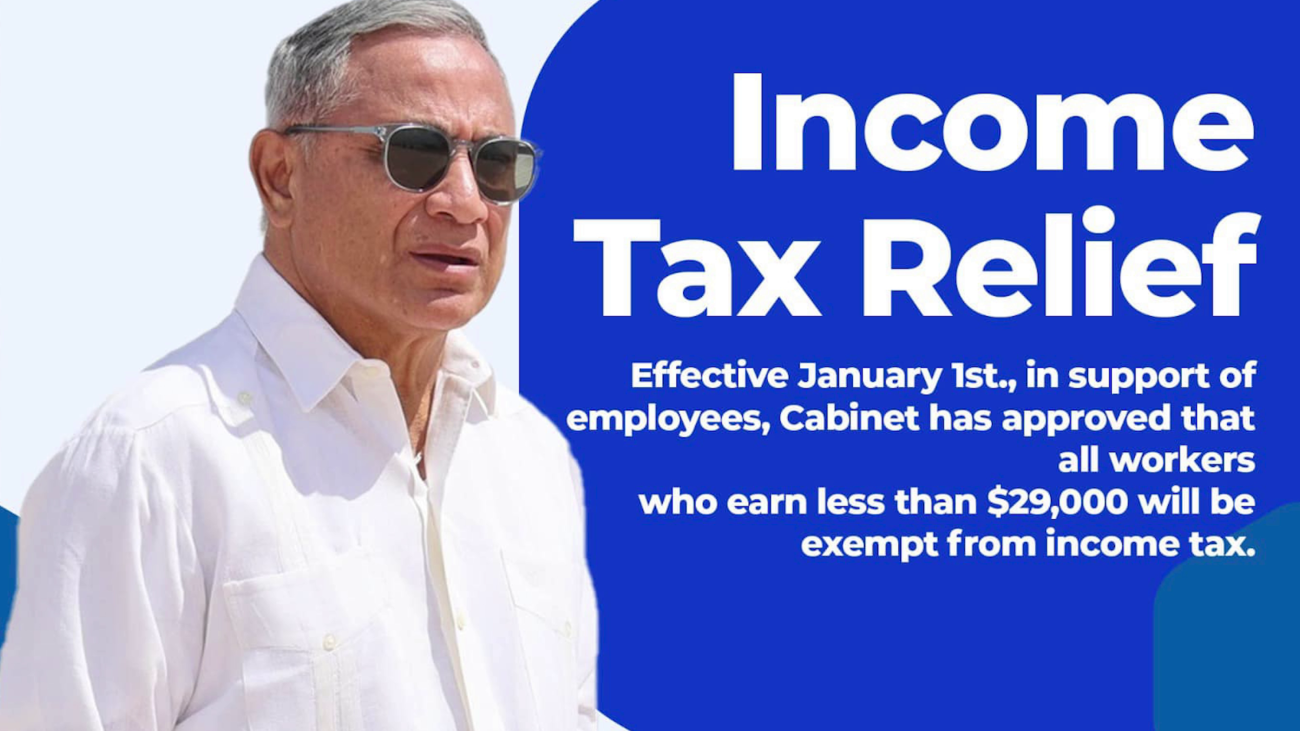

Income Tax Threshold Increase to $29,000

Prime Minister John Briceño also announced a new threshold for income tax exemption. All workers who make less than twenty-nine thousand dollars will be exempted from income tax. The threshold was set at twenty-six thousand dollars under the Barrow Administration. We spoke with PM Briceño after the ceremony. He explained the decision in greater detail.

Prime Minister John Briceño

Prime Minister John Briceño

“When the then prime minister introduced reforms to the then tax regime, I think it was in 20009, I remember taking some time out to show him in the House that what he has done is basically increase the tax on people. He said, the threshold is at twenty-six thousand, five hundred, but once you reach that figure you start to pay tax at twenty thousand. So, you were not really doing much for people. Our plan is to eventually get rid of PAYE. That is our goal. How long it will take us, that is dependent on how fast the economy can grow and how fast revenue can grow, because if we use the tax, we have to get it from somewhere. With growth we hope that we will be able to replace it. This is the first step. We took it up to twenty-nine thousand dollars. Anybody that is earning less than twenty-nine thousand will pay zero tax. And those above twenty thousand will pay. There was also an anomaly, the way the previous government set up the income tax, let’s say you are at a threshold of twenty-nine thousand and you get a raise for let’s say a hundred dollars, twenty-nine thousand, one hundred dollars for year, the tax regime says you jump into another bracket. In many instances the reality is that it eats up the raise that you are getting. That was happening especially in the tourism industry. So, I was told that a lot of people in the tourism industry and other industry were forced to pay that in cash, because the workers were saying, I will not take a pay raise, because I am going to get less money at the end of the day. We made that adjustment so that the tax will never be more than the raise.”

Facebook Comments