How to Save $$$ This Christmas

Christmas is a time of joy and giving, but it’s easy for families to overspend. However, according to economist Rumile Arana, the ones who truly benefit during this time are the people selling. He says that if you’re not the one selling, you’re the one spending.

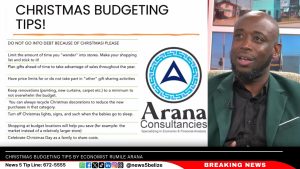

In an episode of Open Your Eyes, Arana shared valuable advice on managing finances during the holiday season. He spoke on the importance of the three M’s of budgeting: “math, it’s management, and most of all, it’s a mentality.” He pointed out that the excitement and emotions that come with the holidays often lead people to overspend.

“Most of the employers will give you all of your money on December 15th, and a lot of people are not used to managing money for an entire month. So people end up in a situation where after Christmas everybody always calls it ‘maaga season.’ But it’s just for the mere fact that you haven’t managed your finances appropriately,” Arana explained.

He also noted that while the average individual might earn about $1,500, and a two-parent household could bring in around $3,000, it’s easy to end up spending twice that amount during Christmas on what might seem like “simple things.”

“You have to understand what your family needs and then cater your budget to that. You do not, at any point, want to go into debt for Christmas,” Arana said. He stressed the importance of planning ahead. “Take a breakdown of the items you want for Christmas, and get the price of them. So these things can be written down so that from September, or mid-year, you plan.”

Arana suggested that by planning ahead and saving in advance, families can avoid financial stress. “If your salary is decent, you can put up a portion of it at different intervals to ensure that when Christmas time comes, when November comes, you’re not that deep in a hole.”

Strategies to Save this Christmas

To help keep spending in check, Arana recommends several strategies. First and foremost, he urges people not to go into debt for Christmas. He also suggests limiting the time spent “wandering” or “window shopping” in stores. Having a shopping list and sticking to it is key to avoiding impulse buys. He said that planning gifts ahead of time is another smart move, as it allows you to take advantage of sales throughout the year.

Arana also advises setting price limits for or skipping “other” gift-sharing activities that could strain your budget. In terms of home improvements, he suggests keeping renovations to a minimum during the holiday season, such as avoiding costly upgrades like painting or new curtains. Instead of buying new Christmas decorations, consider recycling the ones you already have to save money.

To further cut costs, Arana recommends turning off Christmas lights and decorations when not in use, such as when the children go to sleep. Shopping at budget-friendly locations, like markets instead of larger stores, can also help you save. He added that celebrating Christmas Day as a family can help share the costs and make the day more special without overspending. Arana said, “Do not go into debt for Christmas… You have to realise that at the end of the day, the world does not end on December 25th.”

Facebook Comments