DFC Reduces Non-Performing Loans from 25% to 9%

According to Raineldo Guerrero, the Chairman at DFC, the institution has been able to reduce its non-performing loans portfolio from twenty-five percent to nine percent over the last few years. This is a significant achievement. Guerrero says that DFC has increased its revenue collection department to collect these funds.

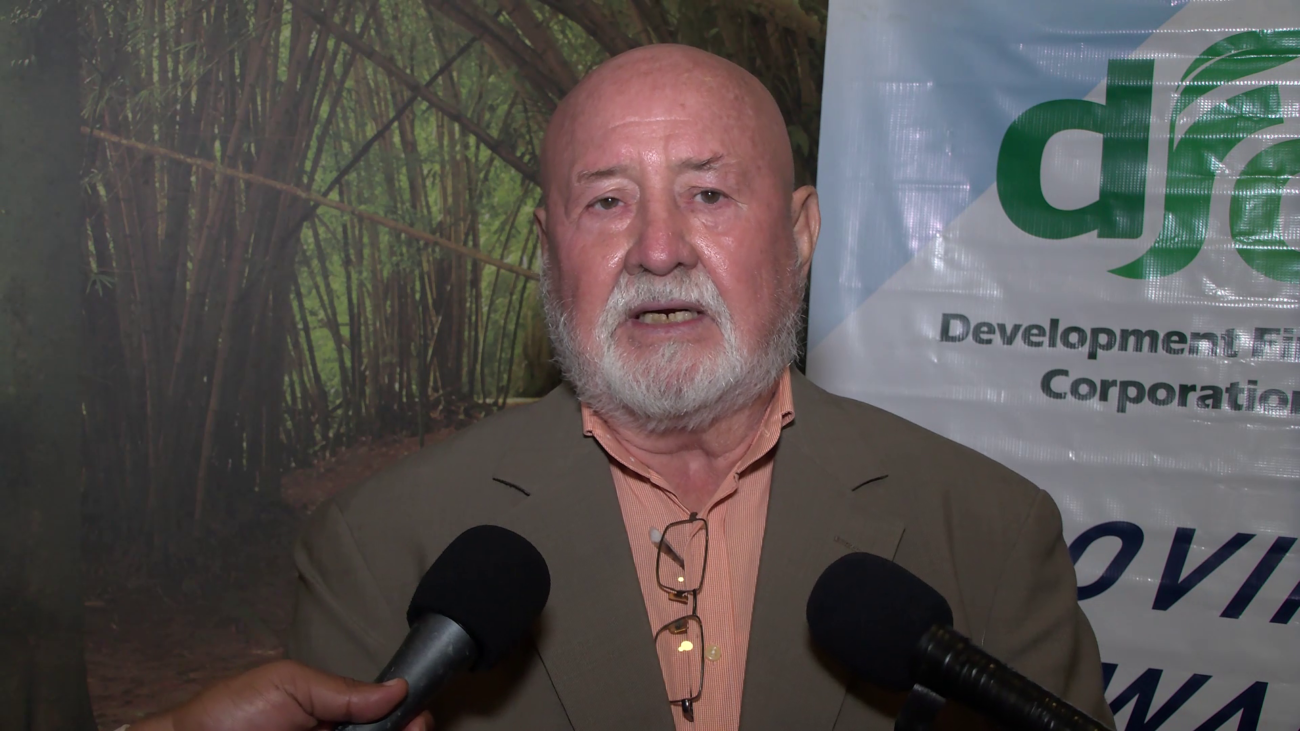

Raineldo Guerrero, Chairman, DFC

“Like everything else, it requires focus. What we saw is that here we are lending all this money, but then we are losing. It didn’t have the level of focus that this new DFC is putting into it. So, you put a group of specialized people who came up with proposal on how we can manage it. That team we have been able to make significant contributions to lower that. So, a strategy had to be formulated to make that a specific focus area. And that is why we are where we are and we intend to go lower. It is a step by step process. We didn’t initially develop the strategy. We decided that this is what we wanted to do then the strategy evolved and the staffing, the people and the contracting of people out there, all of that became a part of it.”

Facebook Comments