Central Bank Strengthen Credit Union Regulatory Framework

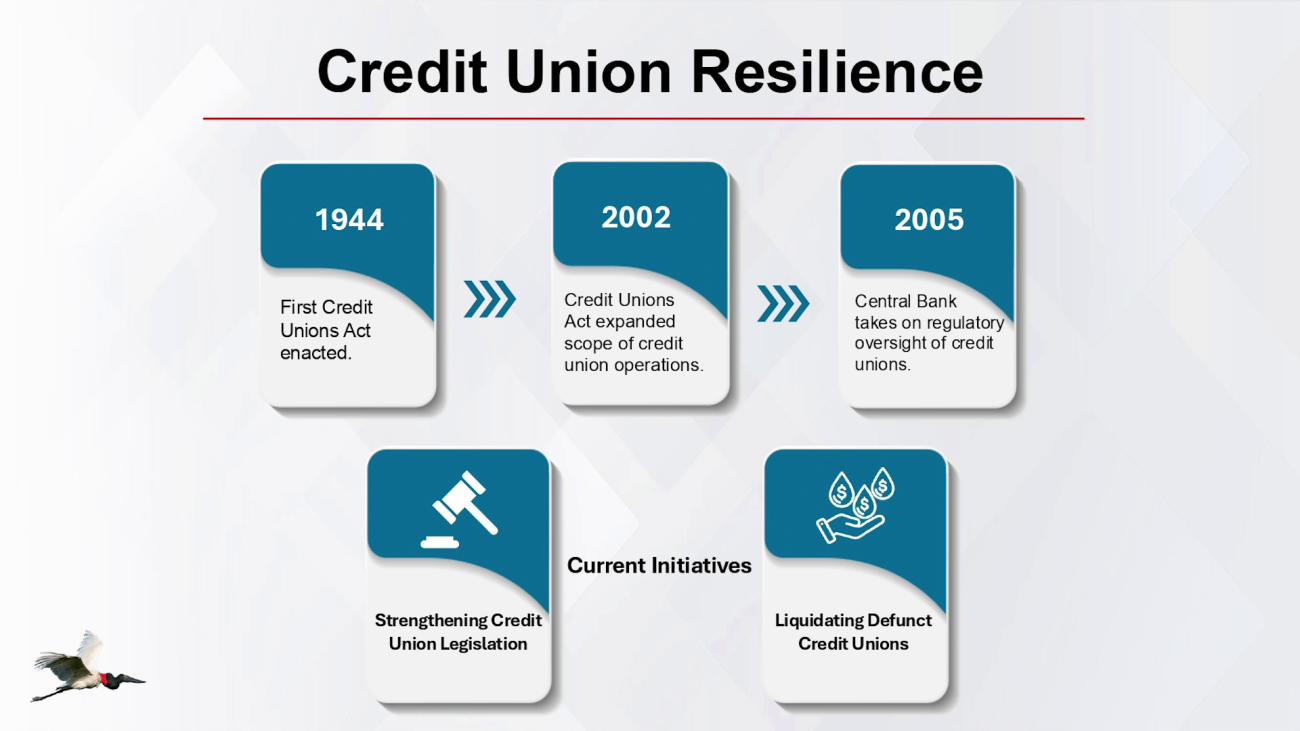

Central Bank Governor Kareem Michael also highlighted the ongoing efforts with credit unions nationwide. Since 2005, when the Central Bank’s governor was appointed as the registrar of credit unions and given regulatory and supervisory authority, Michael’s team has been busy. They’ve been working hard to strengthen the regulatory framework and liquidate inactive credit unions.

Kareem Michael

Kareem Michael, Governor, Central Bank

“The Central Bank has also been working to bolster the resilience of the credit union sector. The entire financial sector has had to adapt with the evolving economic landscape and the Central Bank has undertaken initiatives to build credit union resilience and to enhance competitiveness. In 2005 the Central Bank assumed responsibility for the regulation and supervision of credit unions when the Central Bank’s governor was designated registrar of credit unions. Since then the Central Bank has made strides to address laxities in regulatory oversight and we have seen credit unions enhance their footprint in the sector with an asset growth of over one billion since two thousand six along with expanding their range of products and services. Redrafting credit union legislation ensures that regulatory frameworks keep pace with industry developments. Our second approach is to liquidate long inactive defunct credit unions. The credit union has identified nineteen nonoperational credit unions and have published a notice of liquidation.”

Facebook Comments