Central Bank Confirms It is Investigating Caribi Bleu Casino

Last night, we brought you part three of our deep dive into the operations at Caribi Bleu Casino in San Pedro. Tonight, we have breaking news: the Central Bank has confirmed they’re investigating the casino. As we’ve reported, the casino was caught running an unauthorized ATM that dispenses U.S. dollars. Our investigation has shown that while the Gaming Control Board oversees the casino industry and the Financial Intelligence Unit acts as the supervisory authority, the Central Bank regulates ATM operations and foreign currency exchange. Interestingly, the Central Bank has never approved ATMs inside casinos. This is the first time a casino in Belize has been found operating one, according to the Central Bank. There are still many questions about money laundering laws, but today we got to ask the Central Bank about their investigation into the casino’s activities. News Five’s Paul Lopez has the details.

Paul Lopez, Reporting

Paul Lopez, Reporting

Planning a trip outside of Belize for business, medical reasons, or a vacation? The right way to get foreign currency is through a dealer authorized by the Central Bank. Central Bank Governor Kareem Michael explains how it works.

Kareem Michael

Kareem Michael, Governor, Central Bank

“This is fancy terminology for a domestic bank who has been given the authority to sell foreign currency within our system.”

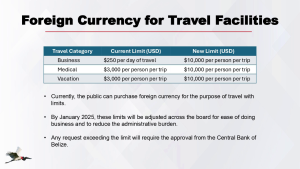

And there is a limit to how much foreign currency any single individual can receive from an authorized dealer.

Kareem Michael

“As it stands now, you can get U.S two hundred and fifty dollars per day, while those travelling for medical and vacation purposes can get U.S three thousand each. This is for the entire trip.”

Customers have been saying the limit is too tight, so the Central Bank is bumping it up to ten thousand U.S. dollars across the board. Now, picture this: you find an unauthorized ATM inside a casino in Belize that spits out U.S. currency. You could skip the application process, dodge a trip to the bank, and fly under the Central Bank’s radar. After weeks of investigation, it turns out that Caribi Bleu Casino in San Pedro has been running an unauthorized ATM that dispenses U.S. currency. An undercover operation inside the casino caught the machine in action, spitting out U.S. bills with just a credit card swipe. Today, we had the chance to ask the Central Bank’s Governor, the head of the regulatory body, some pressing questions about this situation.

Customers have been saying the limit is too tight, so the Central Bank is bumping it up to ten thousand U.S. dollars across the board. Now, picture this: you find an unauthorized ATM inside a casino in Belize that spits out U.S. currency. You could skip the application process, dodge a trip to the bank, and fly under the Central Bank’s radar. After weeks of investigation, it turns out that Caribi Bleu Casino in San Pedro has been running an unauthorized ATM that dispenses U.S. currency. An undercover operation inside the casino caught the machine in action, spitting out U.S. bills with just a credit card swipe. Today, we had the chance to ask the Central Bank’s Governor, the head of the regulatory body, some pressing questions about this situation.

Paul Lopez

“What sort of investigation has the Central Bank launched into this as a part of your mandate to secure Belize’s financial sector?”

Kareem Michael

Kareem Michael

“I am sure you will appreciate that I can’t say much on that because it is a live investigation and one that began well before your media house started to run the story.”

Governor Michael confirmed that the Central Bank is looking into Caribi Bleu Casino’s use of the unauthorized ATM. News Five learned that although the ATM was reported to the Central Bank months ago, their busy schedule delayed the sting operation until a couple of weeks ago. Michael explained that these unauthorized transactions can upset the local foreign exchange market, as U.S. dollars can be sold at any price set by the dealer, creating a parallel market and a dual exchange rate.

Paul Lopez

“Is it a common practice to have atm machines in casinos under the National Payment System Act.”

Kareem Michael

Kareem Michael

“Absolutely not.”

In fact, it is unheard of in Belize. News Five has confirmed that this is the first such instance where a casino in the country has been operating an ATM, more so one that dispenses U.S. currency. So, how did Caribi Bleu Casino manage to pull this off? The short answer: with some seriously sophisticated tech skills.

Paul Lopez

“How is it that a casino can operate an atm undetected for a period of time?”

Kareem Michael

Kareem Michael

“I got a better question, how is it configured? So yeah.”

News Five has confirmed that the ATM machine inside Caribi Bleu Casino was connected to a tower in Miami. Through this technology, the machine was able to process a user’s banking information and dispense the amount requested from the U.S currency loaded into the machine. One of the pressing questions at this point is, where does U.S. currency loaded into the atm comes from and if these funds are linked to money laundering? Michael says F.I.U is the supervisory authority over casinos. So, they will have to establish these answers. Notably, the Central Bank is a member of the National Anti-Money Laundering Committee, as is the FIU.

Kareem Michael

Kareem Michael

“The Central Bank is a member of part of NAMLAC. The Central Bank has supervisory authority for the financial institutions I listed. Casinos and these non-financial entities fall under another member of NAMLAC, namely the FIU.”

But our calls and messages to the Director of FIU have gone unanswered for a couple of weeks. The Chairman of the Gaming Control Board, Bob Bounahra, also told us on Tuesday that the board does not have authority over financial regulations, but that if the Central Bank or the FIU raises and issue and brings it to the attention of the board, it will take the necessary measures. All this probing has brought to our attention a gap in cooperation between these entities, which Michaels confirmed.

Paul Lopez

“So how would you all receive information or become aware of this suspicious transaction, if not through the Gaming Control Board, the FIU?”

Kareem Michael

Kareem Michael

“Absolutely, because they again are the supervisory authority. Now there is an opportunity, I think this is what you are suggesting, if whether or not there can be greater cooperation between all entities like this because it is one anti-money laundering framework. Again there is a NAMLC committee where such things can be presented and tabled and everybody can be involved.”

News Five has confirmed that Caribi Bleu Casino will receive a cease-and-desist order by Friday as the Central Bank and the FIU continue their investigation. When the Central Bank establishes that Caribi Bleu Casino acted in contravention of the law, the director, general manager and secretary can be held liable, at least under the Exchange Control Act. We’ll keep following this story and push for answers from the FIU about its investigation into the source of the funds. Reporting for News Five, I am Paul Lopez.

Facebook Comments