Belize’s Economic Journey in 2024: Growth, Challenges, and Opportunities

As we wrap up 2024, News 5 is excited to bring you our digital Year in Review! This year, we're diving into the highlights and challenges of the past twelve months, all organised by themes. Join us as we look back at the stories that shaped our year…

Belize’s economy reflects a year of significant fiscal manoeuvres, development strides, and critical reforms under the leadership of Prime Minister John Briceño. The administration has worked to stabilise the economy while addressing challenges such as inflation, rising living costs, and public sector efficiency.

Fiscal Performance and Budgetary Allocations

The fiscal year was defined by a projected revenue of $1.5 billion and expenditures of $1.6 billion, emphasising fiscal prudence and targeted investments. Revenue was primarily sourced from goods and services ($791 million), income and profits ($365 million), international trade and transactions ($223 million), and property taxes ($7.17 million). On the expenditure side, 73% of the budget was allocated to recurrent spending, with wages and pensions comprising 30 and 7 cents of every dollar, respectively. Capital investments focused on infrastructure ($49 million), health ($35 million for NHI expansion), and education ($12 million for the Education Upliftment Project), which saw 12 additional high schools join the initiative, benefiting approximately 6,000 students.

Public Debt Management and Economic Growth

Belize also achieved significant progress in public debt management, reducing its debt-to-GDP ratio from 103% in 2020 to 64% by the end of 2024. This was facilitated by primary surpluses averaging 5% of GDP over three years and growth in sectors such as tourism, construction, and business process outsourcing (BPO). The Central Bank reported a robust 7% GDP growth for 2024, exceeding regional averages, with GDP per capita rising by $5,500 compared to 2020. Key contributors to this growth included wholesale and retail trade, accommodations, and transportation.

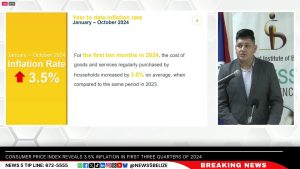

Inflation and the Cost of Living

Inflation, while easing from 6.3% in 2022 to 3.6% in 2024, remained a concern for households, particularly due to rising costs of locally produced food. Staples like bread, meats, and cooking oils saw significant price increases, with 63% of inflation attributed to domestic prices. The increase in the minimum wage to $5 per hour benefitted over 40,000 workers but also contributed to mild inflationary pressures. Prime Minister Briceño defended the policy, citing its positive impact on purchasing power and economic activity.

The Multidimensional Poverty Index (MPI) revealed a 10.1% reduction in poverty since 2021, driven by improvements in underemployment, food security, and access to services. However, the intensity of poverty among affected households remained steady at 38.4%. Unemployment reached a historic low of 2.1%, though disparities persisted in rural communities, where poverty reduction efforts lagged.

Innovations in Financial Systems

Belize’s financial system underwent transformative changes, including the introduction of a credit reporting system by the Central Bank, enabling Belizeans to build credit scores based on traditional and non-traditional data such as utility payment history. Additionally, domestic banks reduced fees for online transactions and ATM withdrawals to promote financial inclusion and modernise payment systems.

Public Spending Challenges

A World Bank review highlighted inefficiencies in public spending, particularly in education and health, with public sector wages accounting for 41% of total spending. In response, the government initiated pension reforms and targeted pay scale imbalances to enhance productivity and fiscal flexibility.

Innovations in Financial Systems

Trade developments included modest growth in banana and citrus exports, while sugar exports faced shipment timing issues. Nonetheless, sugar farmers benefitted from record payments due to improved global prices and strategic investments. Domestic imports rose by 9.2% compared to 2023, reflecting increased demand for machinery and transport equipment.

Citizen perspectives on the economy were mixed. While the government reported easing inflation, many Belizeans cited rising costs for groceries and basic services. Consumer confidence, as measured by the Statistical Institute of Belize, declined in August due to concerns over durable goods and future economic stability.

Facebook Comments