Easter Fun this Weekend, and Financial Hangover Tuesday Morning? Think Again

It’s that time of year again—when the sun is blazing, the beaches are calling, and Belizeans are packing up for fun-filled Easter getaways with family and friends. But while the long weekend promises memories and adventure, it also brings a big temptation: overspending.

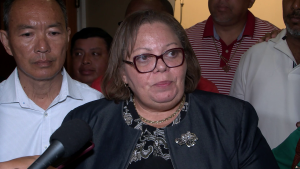

Local economist and financial consultant Rumile Arana, owner of Arana Consultancies, has a few pieces of advice to keep in mind during these days. He urges Belizeans to keep a close eye on their wallets and not fall into common financial traps.

“The whole idea of you having the urge that you need to go somewhere or be at a big resort during Easter is simply just that we are buying into this whole consumerism type of culture,” Arana warned.

Easter is one of those holidays where many forget to plan ahead—especially when it comes to money. Social pressure, last-minute planning, and even quick loans often lead people to spend way more than they should. But it doesn’t have to be that way.

To help Belizeans enjoy the Easter vibes without the financial hangover, Arana shared five important tips that could save a wallet outcry:

- Create a Budget: Plan your spending in advance. Allocate set amounts for food, drinks, transport, and entertainment. The big reminder here? Your next payday might still be weeks away. Spend accordingly.

- Pool Resources: Road trips? Beach weekends? Arana says make it a team effort. Carpooling or group trips to share transport and accommodation costs can seriously ease the load on your wallet.

- Buy in Advance: Impulse buys at events or bars can quickly add up. Arana recommends a smarter approach: purchasing alcohol and snacks beforehand to cut costs. A little pre-planning goes a long way.

- Opt for Cost-Effective Trips: Not every memorable Easter needs to be a luxury vacation. Day trips to riversides or local beaches offer enjoyment without the hefty price tag. Arana also suggests booking places with small kitchens so you can cook and save on meals.

- Avoid Loans for Leisure: This one’s a biggie. “If you have to borrow money to enjoy your Easter, you’re always already starting off on the wrong foot,” Arana warned. Holiday-time loan offers are everywhere, but he warns: don’t fall for them. Basically, you’re sacrificing future income for short-term fun.

While it is healthy to have fun every now and then, it’s important to remember that there will be days to follow the excitement of the long Easter weekend. With a bit of planning and smart choices, every family can have a great time without waking up Tuesday morning full of financial regret.

Here’s one of Arana’s “braata” advices: saving for next year’s Easter can start right after this year’s one. Setting aside a couple of dollars every month towards next year’s Easter can start building the discipline one needs during times when one is tempted to splurge for the moment’s experience.

So before you hit the road, pack the cooler, or book that weekend escape—make sure your budget’s in check. Your future self will thank you.

Facebook Comments