Exporters to The U.S. Prepares for Economic Decline

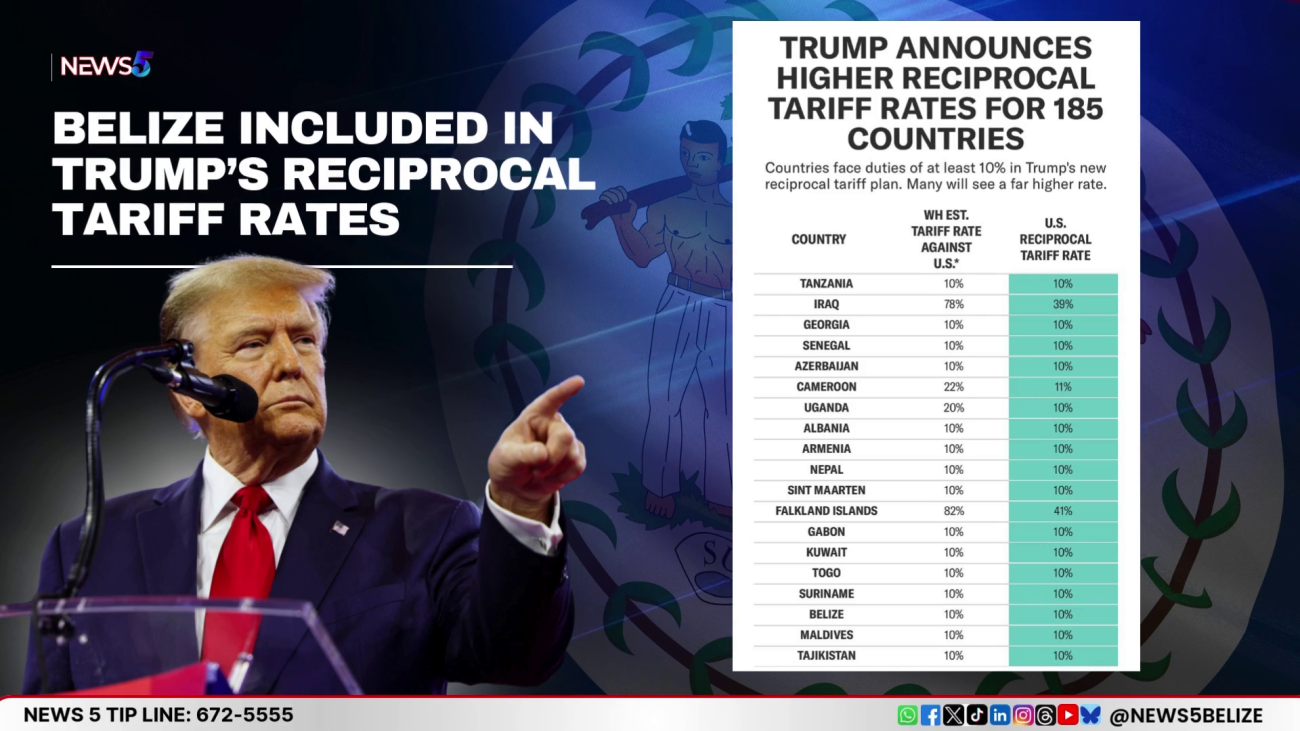

News Five has been closely following the Trump administration’s ten percent reciprocal tariff on Belizean goods. The new policy is set to take effect on April 5th. Since the announcement, the Government of Belize has held a high-level meeting to discuss its impact on trade relations and economic growth. G.O.B. has assured Belizeans that it will use all available avenues to address the situation. However, concerns among private sector stakeholders are growing daily. Marie Sharp’s Fine Foods Limited, which has enjoyed duty-free exports to the U.S. for decades, now faces the end of these exemptions. It’s a tough spot for exporters with the U.S. as their largest market. Reporter Paul Lopez has more details.

Paul Lopez, Reporting

The Trump administration’s ten percent reciprocal tariff on Belize could have major impacts on exporting businesses. For instance, Marie Sharp Fine Foods Limited sends most of its products to the U.S. market. Adding a tax to products that have enjoyed duty-free export for decades is bad for business, says Jody Williams, the Chief Sales and Marketing Director.

Jody Williams

Jody Williams, Chief Sales and Marketing Director, Marie Sharp

“Well you know, I like the wording that is being used in the media. Trump has slapped Belize with a ten percent reciprocal tariff, because it is a big slap to Belize, to our developing nation of Belize. In that regard, it affects all exporters. Here at Marie Sharp we export to the U.S. market and for all the years Mrs. Sharp and the company has been exporting to the U.S., since nineteen, eighty-nine, to before this decision was made there was zero percent tariffs imposed on our products.”

Marie Sharp, the founder of the company, talked about this problem in her 2018 biography. She mentioned that any changes to the CARICOM Free Trade Agreement could slow down the company’s shipping and distribution to the U.S. Now, six years later, the company must get ready to deal with those impacts.

Jody Williams

Jody Williams

“We are worried about this, because let us say for example we never put into consideration these cost of tariff into our products, into our business in the United States, likewise our importers in the U.S., they never had that ten percent in their pricing. So let us say we have our products in Walmart, Kroger’s, Amazon, that ten percent is not included there. So more than likely, this will slow down sales, slow down momentum, and less foreign exchange coming into the country. We my have to halt certain expansions because we had full momentum when it comes to U.S. sales especially with Walmart.”

Economic consultant Dr. Leroy Almendarez shared his thoughts on how the Trump administration’s tariffs are impacting Belize’s exports. He explained that even though the CARICOM Free Trade Agreement is in jeopardy, it still offers some bargaining power for developing countries like Belize.

Leroy Almendarez

Dr. Leroy Almendarez, Economic Consultant

“In 1983 the United States established what is called the Caribbean Basin Initiative, which later morphed into what is called the Caribbean Basin Economic Recovery Act. What is the purpose of that, to stimulate growth within the CARICOM economies. Products that qualify and comply to certain standards by the United States, that those products would then go into the U.S. duty free. That still exists. Then you have the Caribbean Basin Trade Partnership Agreement, which expanded that. There are even carve out for countries like Haiti with apparel. That still exist which means a number of our products can still take advantage. What the U.S. does is this, utilization rate. If the U.S. imports collectively as a block from CAIRCOM and it imports is about forty-nine percent of total imports and twenty-four percent of total exports, that simply means there is some level of significance there. And if it relies on us for certain exports from Belize that means we have to maintain those quotas.”

Dr. Almendarez mentioned that the U.S. trade representative in Belize needs to create a report with recommendations on whether to suspend these tariffs, in line with the trade agreement. Meanwhile, the Government of Belize isn’t wasting any time. Just one day after the tariff was imposed, they held a high-level meeting to discuss its potential impact. In a press release, the government promised to use all political and diplomatic channels to tackle the issue. However, who ends up paying the ten percent tariff—whether it’s the exporter in Belize or the importer in the U.S.—depends on the methods used to get the products there.

Dr. Almendarez mentioned that the U.S. trade representative in Belize needs to create a report with recommendations on whether to suspend these tariffs, in line with the trade agreement. Meanwhile, the Government of Belize isn’t wasting any time. Just one day after the tariff was imposed, they held a high-level meeting to discuss its potential impact. In a press release, the government promised to use all political and diplomatic channels to tackle the issue. However, who ends up paying the ten percent tariff—whether it’s the exporter in Belize or the importer in the U.S.—depends on the methods used to get the products there.

Jody Williams

Jody Williams

“It all depends on shipping Inco terms. For example, let us say we use the Inco term FOB Belize, our prices are to the Port of Belize. We get it from factory to there that is the prize. Once the ship sales, automatically the ownership of those good transfer to the importer. So our importer in the U.S. will pay that ten percent, because they are importing into the U.S. this is the situation. Our importer has never included this cost, it is a surprise. So they say let us have a meeting, we cant take on the ten percent, let us do fifty, fifty, you do five percent, we do five percent. So at the end of the day we are still end up paying something. Let us change the Inco terms saying we are delivering directly to Walmart, we are doing the importation, Marie Sharp, so we will pay that full ten percent.”

Reporting for News Five, I am Paul Lopez

Facebook Comments