House to Introduce Temporary Zero GST Legislation Today

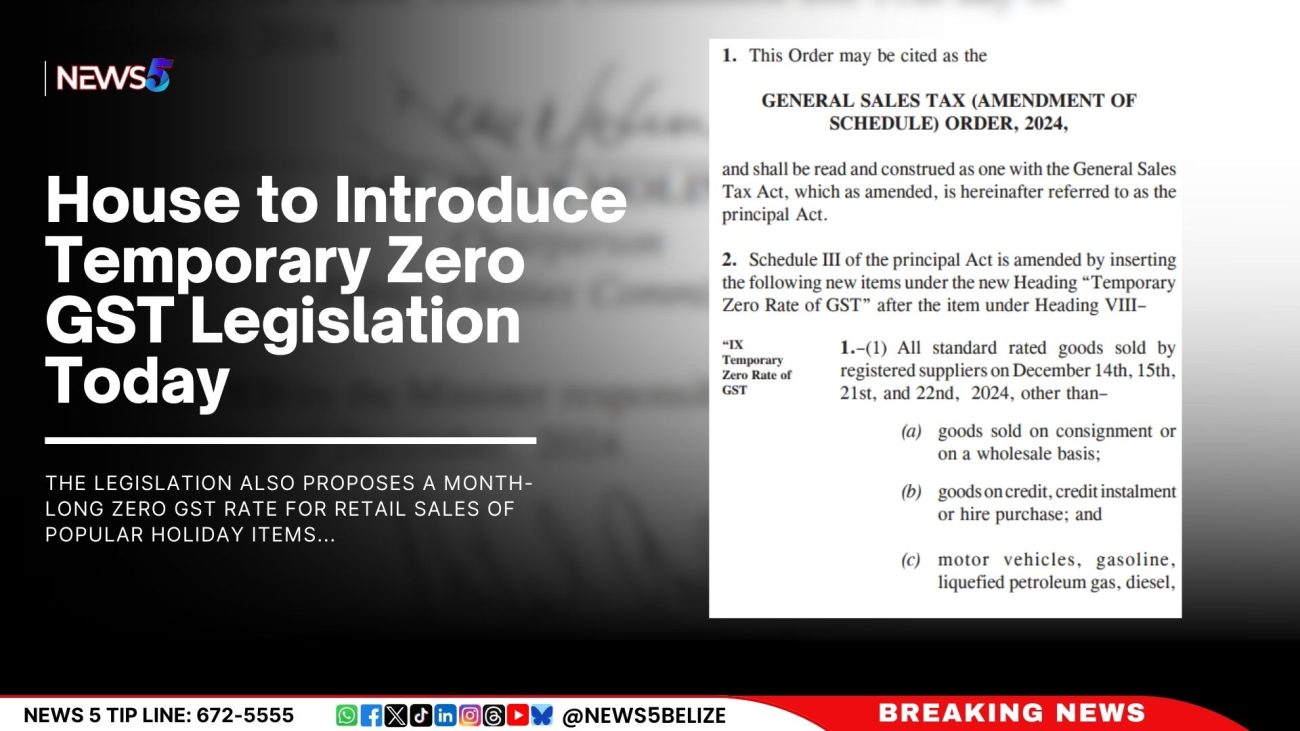

The Briceño Administration is set to introduce legislation in the House of Representatives today that would provide temporary financial relief to consumers during the holiday season. The proposed measure, outlined in Statutory Instrument No. 152 of 2024, seeks to establish a zero rate of General Sales Tax (GST) on specific goods for select dates in December 2024.

The General Sales Tax (Amendment of Schedule) Order, 2024, will be presented by Prime Minister and Minister of Finance, John Briceño. If approved, the measure will apply a zero GST rate to all standard-rated goods sold by registered suppliers on December 14th, 15th, 21st, and 22nd. However, notable exclusions apply. Goods sold on consignment or wholesale, as well as those sold on credit or hire purchase, will not qualify for the tax relief. Additionally, motor vehicles, gasoline, liquefied petroleum gas, diesel, guns, ammunition, cigarettes, and alcoholic beverages are excluded from the exemption.

The legislation also proposes a month-long zero GST rate for retail sales of popular holiday items, including picnic shoulder ham, smoked ham leg, and imported turkey. This measure is aimed at making festive meals more affordable for Belizean families.

Despite the zero-rate concession for certain goods on the specified dates, GST will still be charged on taxable importations. The proposed order, which is subject to negative resolution, would automatically become effective unless annulled by the National Assembly. It is set to expire on December 31, 2024.

Facebook Comments