Belize’s Foreign Exchange Holding on the Rise

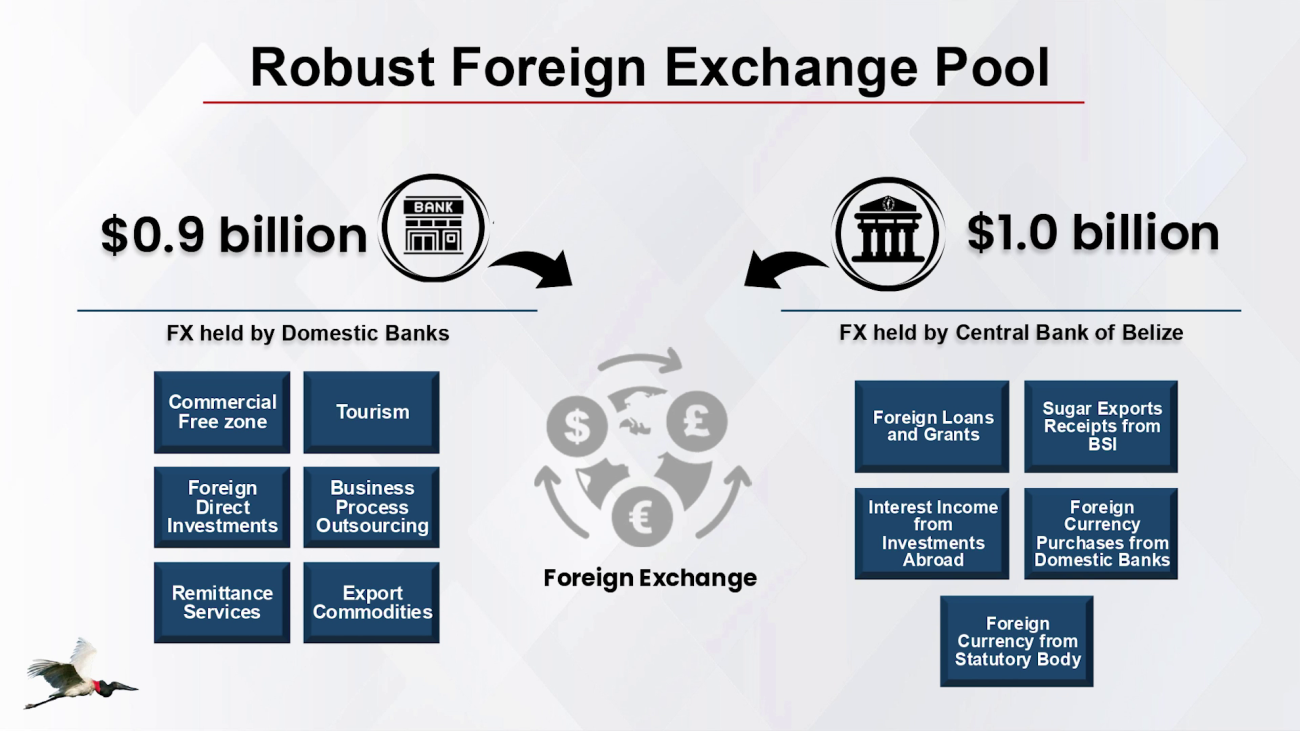

Foreign exchange is vital for a small, open economy like Belize. Trading goods with other countries requires foreign currency, making Belize’s foreign exchange assets crucial. According to Central Bank Governor Kareem Michael, the country’s foreign holdings are in good shape. Right now, the entire banking system holds one point nine billion dollars in foreign exchange assets. Governor Michael shared more details during Wednesday’s Central Bank press conference.

Kareem Michael

Kareem Michael, Governor, Central Bank

“Currently the foreign exchange assets of the entire banking system, those held by commercial banks and those of the Central Bank, stands at one point nine billion. And of this total the pool of official reserves by the Central Bank totals one billion, equivalent to four months of imports, comfortably above the three months benchmark. In contrast the pool of reserve held by the domestic banks are just under Central Bank’s one billion, at nine hundred million. And, this is the highest it has ever been on record. Factors driving this performance are tourism leading the way at one point two billion, up almost eleven percent for the year to date, January to September. Export Revenue is up marginally by point one percent or ten basis points and total seven hundred and sixty-three million, up to September. FDI very strong for the first three quarters of the year, by four-four percent, up one hundred and ninety-five point four million. BPOs helps to explain some of the labor market’s pressures or tightness, totals a hundred and sixty-nine point one million and up seven point four percent. Remittances up small, one point two percent, two hundred and twenty-two million. And loan disbursements, I don’t mind this one being down at all, fifteen point seven percent and total a hundred and forty-nine point four million dollars.”

Facebook Comments