Get Ready for Credit Score in Belize

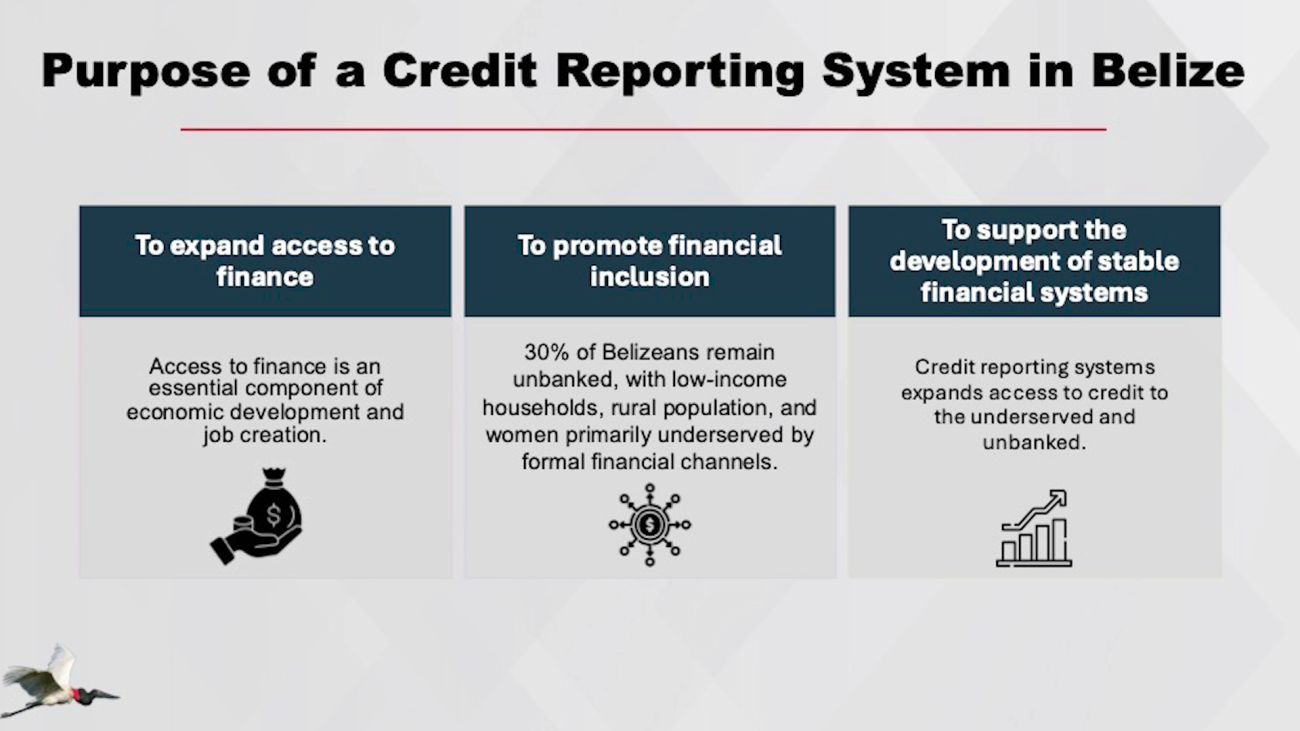

As part of its wave of changes, the Central Bank of Belize is gearing up to launch a credit reporting system. Central Bank Governor Kareem Michaels says this new system will open up access to finance, boost financial inclusion, and help maintain a stable financial system. With this credit reporting system, every Belizean will get a credit score, which will act as your reputational collateral when applying for loans and mortgages. The Central Bank has chosen the well-known global credit bureau operator C.R.I.F to spearhead this initiative. Governor Michaels shared more details with us.

Kareem Michael

Kareem Michael, Governor, Central Bank

“How will this work? Consumers will be able to build what is now known as reputational collateral through credit history. So shift your minds out of the traditional forms of collateral, we are talking about reputational collateral. The CRS will expand the credit to credit and lower cost for healthy bowers. Consumers will be able to proof of credit readiness with nontraditional data. It will also help to prevent over indebtedness with lenders better able to calculate a borrower’s capacity to service his or her own debt. For lenders it will reduce the symmetry of information so lenders will have a better understanding of a borrowers credit history. It also promotes transparency and fairness in the lending process. This is the ecosystem we are looking at for credit information history. What we want to point out is part of your credit score is actually how you have been paying your utility bill. When I mention and talk about nontraditional forms of assessing your credit history and repayment capacity. This is one of those things.”

Facebook Comments